Your Partner in Wealth Creation & Risk Management

In today’s complex financial environment, participation alone isn’t enough. At Re. Analytics, we provide institutional-grade frameworks, research, and strategic guidance to help you manage risk, optimize capital, and make decisions with clarity and confidence.

Strategic Company & Sector Research

Deep research isn’t about generating buzz — it’s about understanding reality before taking action.

We provide:

Company Research: Comprehensive analysis of financials, earnings trends, competitive dynamics, and risk vectors.

Sector & Industry Intelligence: Forward-looking reports on key US and global sectors, identifying structural shifts, growth drivers, and emerging risks.

Market Drivers & Regime Assessment: Contextual insights into macro, regulatory, and liquidity regimes that influence valuations and opportunities.

Our research translates complexity into clarity - so you make decisions you can defend with logic, not emotion.

Quarterly Industry Reports

Markets evolve. Our quarterly reports help you stay ahead of the curve.

Each report includes:

Sector trends and structural forces

Macro outlook and regime shifts

Thematic opportunities and risk flagging

Relevant case studies and benchmark comparisons

These are not generic summaries - they are forward-looking strategic guides designed to inform positioning and planning.

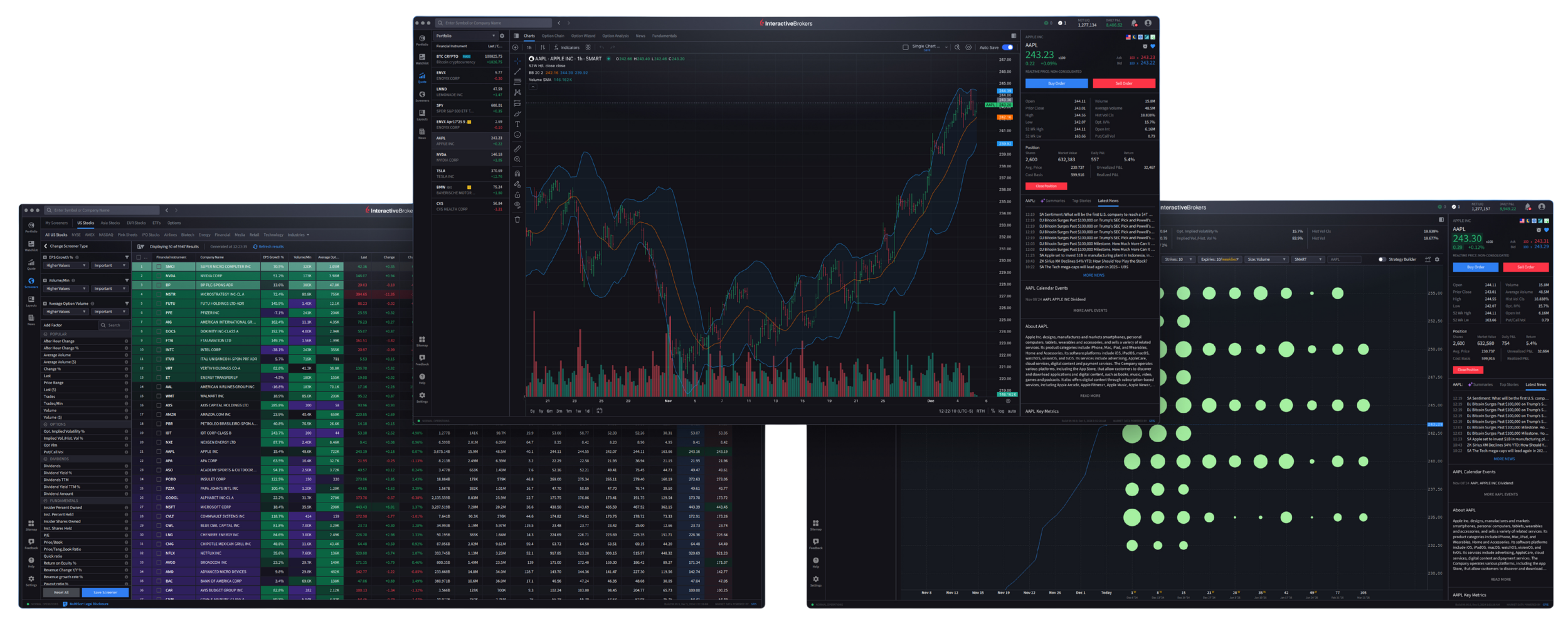

Education, Tools & Frameworks

Quality strategy comes from structured thinking.

We provide:

Educational frameworks for risk and portfolio management

Tools and calculators that help you quantify exposures

Exportable formats (PDF/Sheets) that make insights usable

The Re. Analytics Difference

We don’t chase headlines or offer simplistic signals.

We help clients:

Base decisions on data-supported insight

Calibrate risk in complex environments

Access global markets efficiently

Design portfolios with structure, not speculation

This is institutional thinking for all investors and founders.

Private Desk Support (Australia)

Structured guidance for investors who want to operate professionally.

The Private Desk is our ongoing support service for Australian investors building portfolios with institutional discipline — without handing over control or capital.

This service is designed to sit alongside self-directed investing, providing clarity, structure, and accountability as markets and portfolios evolve.

Private Desk members receive:

Quarterly strategy sessions

Monthly stock reviews based on your interests

On-demand email access for questions and clarification

Full access to our paid research archive

This service bridges the gap between education and execution — delivering professional insight without requiring six-figure capital or discretionary management.

Portfolio Diagnostics & Analysis

A portfolio is more than a collection of positions — it’s a complex system of risk and capital flows.

Our portfolio analysis:

Evaluates exposure and concentration risk

Assesses volatility and drawdown potential

Highlights behavioural and structural risk signals

Provides actionable insights to improve positioning and risk management

Whether you’re building a long-term core portfolio or refining a tactical allocation, we help you quantify vulnerabilities and seize opportunities that align with your objectives.